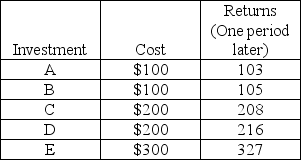

Table 12.2

Returns on Investment

-If Table 12.2 represents all the investments available to the economy, the nominal interest rate is 4.5 percent and there is no inflation, what will be the level of investment in the economy?

Definitions:

Risk-Free Return

The theoretical return on an investment with zero risk of financial loss, often represented by the return on government securities.

Treynor's Measure

A performance metric for determining how well an investment portfolio has compensated the investor for the risk taken, using beta as the risk measure.

Risk-Free Return

The theoretical return on an investment with zero risk, typically represented by government bonds or bills, serving as a benchmark for assessing investment performance.

Information Ratio

This ratio measures the excess return of a portfolio over the benchmark's return, relative to the volatility of those excess returns, indicating the portfolio manager's ability to generate consistent excess returns.

Q7: Suppose planned expenditures exceed output. Explain how

Q9: Compared to consumption, investment is a much

Q29: The transaction demand for money comes mostly

Q79: Describe the relationship illustrated by the Laffer

Q87: When federal government spending amounts to less

Q127: Refer to Table 11.1. What is the

Q130: Refer to Scenario 12.1. By what approximate

Q136: Which of the following is a bank

Q151: At a fixed income level, an increase

Q153: Refer to Figure 11.5. A decrease in