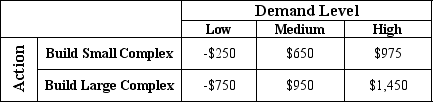

The following payoff table (in thousands of dollars) considers three possible levels of demand in a housing complex.If there is a 45% chance that the demand level will be low, 30% that it will be medium and 25% chance that it will be high, what is the expected value of perfect information?

Definitions:

Maturities

The set dates at which a bond or other financial instrument's principal amount is due to be paid back to the investor.

LEAPS

Long-Term Equity Anticipation Securities, which are options contracts with expiration dates longer than one year, offering longer-term investment strategies.

Initial Maturities

The original duration until the expiration or due date of a financial instrument, such as a bond or loan, when first issued.

Exchange-Traded Options

Financial derivatives that give the holder the right, but not the obligation, to buy or sell a specific amount of a security at a set price on or before a certain date.

Q1: Feelings from the past that have not

Q8: When a multimodal therapist observes a client

Q11: A manufacturing plant for recreational vehicles receives

Q12: Feminist therapists often prefer to lead women

Q13: Rogers's view on research into the effectiveness

Q17: In narrative therapy, letters written by therapists

Q34: Attention to family boundaries is most important

Q35: In existential therapy, freedom refers to the

Q119: Data were collected on annual personal time

Q138: College students were given three choices of