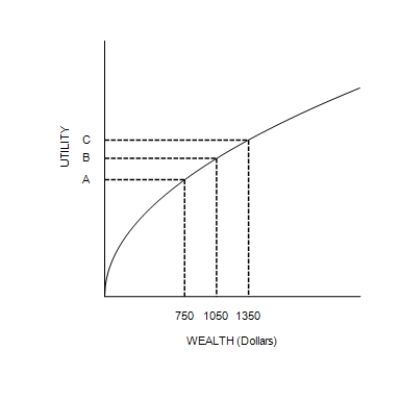

Figure 27-1

The following figure shows a utility function for Ren.

-Refer to Figure 27-1. Suppose Ren begins with $1,050 in wealth. Starting from there,

Definitions:

Marginal Tax Rate

The rate of additional federal income tax to be paid on an extra dollar of income.

Average Tax Rate

The proportion of total income that is paid as taxes, calculated by dividing the total taxes paid by the total taxable income.

Federal Personal Income Tax

A tax levied by the federal government on the income of individuals, adjusted for various deductions and exemptions.

Personal Income Tax

A tax levied on individuals or households based on the level of their income.

Q71: What is meant by an asset bubble?

Q73: The market for insurance is one example

Q84: All else equal, if there are diminishing

Q102: Most spells of unemployment are short, and

Q115: It is only among the least skilled

Q117: The producer price index measures the cost

Q189: Data on the unemployment rate in the

Q197: If consumers reduced their spending, what would

Q215: Most spells of unemployment are short, and

Q327: Some long-run unemployment may be explained by