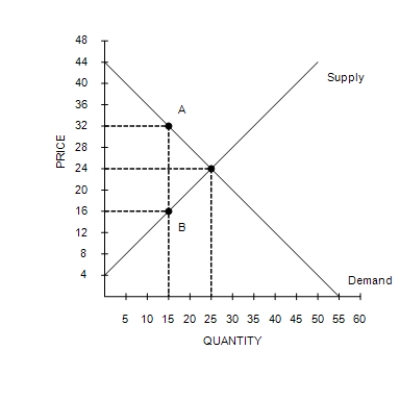

Figure 8-3

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-3. As a result of the tax, consumer surplus decreases by

Definitions:

General Journal

A primary accounting record used to record all types of transactions before they are posted to the specific accounts in the ledger.

General Ledger

The main accounting record of a business that uses double-entry bookkeeping, which contains all the financial accounts and transactions of the company.

Subsidiary Ledgers

Detailed records that contain information about specific accounts, such as accounts receivable or payable, that support the summarized data in the general ledger.

Sales Invoice

A paper provided by the seller to the buyer that outlines the goods or services offered, the total due, and the conditions of payment.

Q47: When a tax is imposed on a

Q80: Refer to Figure 8-3. Suppose a 20th

Q111: Refer to Scenario 9-2. With no trade

Q133: The burden that results from a tax

Q145: The elasticities of the supply and demand

Q174: A price ceiling set above the equilibrium

Q181: Total surplus in a market is consumer

Q182: A benevolent social planner would prefer that

Q194: Refer to Figure 9-6. The tariff<br>A)decreases producer

Q245: Refer to Figure 6-19. If the government