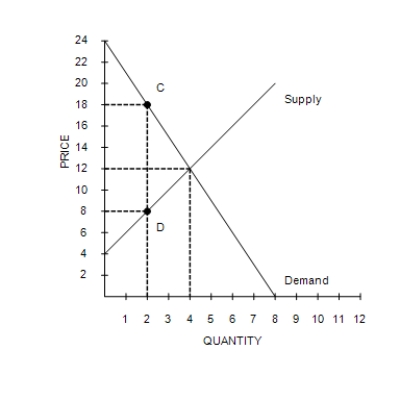

Figure 8-2

The vertical distance between points C and D represents a tax in the market.

-Refer to Figure 8-2. The imposition of the tax causes the price received by sellers to

Definitions:

Efficiency-Enhancing Innovations

Changes to existing products or ideas that make them lower cost.

Market-Creating Innovations

Innovations that generate new markets by fulfilling unmet needs or creating new categories of products or services.

New Class of Consumers

Emerging segments of the market population with distinct characteristics, behavior patterns, or purchasing preferences not previously accounted for.

Market-Creating Innovations

Innovations that create new markets through meeting previously unfulfilled needs or establishing new types of products or services.

Q4: Refer to Figure 7-12. If the government

Q21: Refer to Table 7-3. If you have

Q32: When a country allows international trade and

Q39: Economists use the government's tax revenue to

Q44: Refer to Figure 9-4. Consumer surplus in

Q83: When a tax is imposed on a

Q111: Refer to Scenario 8-3. Suppose that a

Q113: Connie can clean windows in large office

Q133: Economists agree that trade ought to be

Q165: The most important tax in the U.S.