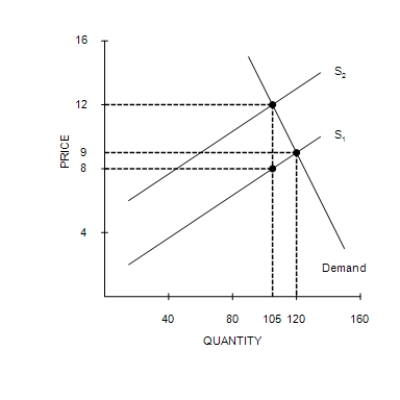

Figure 6-13

-Refer to Figure 6-13. Suppose buyers, rather than sellers, were required to pay this tax (in the same amount per unit as shown in the graph) . Relative to the tax on sellers, the tax on buyers would result in

Definitions:

Deferred Profit-sharing Plans

A type of retirement plan in which employees receive a share of the company's profits at a future date, typically upon retirement.

Contributory Benefits

Benefits, typically related to pension or insurance, that require contributions from both the employee and the employer.

Indirect Pay System

A compensation approach that includes non-wage benefits provided to employees, such as health insurance, retirement plans, and paid time off.

Employee Performance

The record of outcomes and behaviors exhibited by an employee in fulfilling their job responsibilities, often assessed against predefined objectives or criteria.

Q1: Suppose demand is given by the equation:<br>Q<sup>D

Q13: A tax on buyers decreases the quantity

Q88: Demarcus says that he will spend exactly

Q112: Supply is said to be inelastic if

Q145: Refer to Table 7-11. Both the demand

Q188: You receive a paycheck from your employer,

Q189: Price ceilings and price floors that are

Q249: One disadvantage of government subsidies over price

Q267: A decrease in the price of a

Q317: If the demand curve is more price