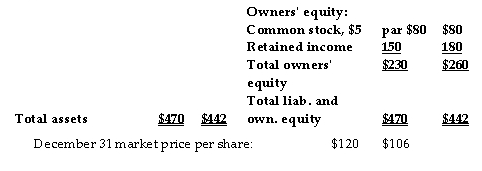

The following are the income statements and balance sheets for Coors Company:

32

32  The return on sales for Coors Company in 20X2 is:

The return on sales for Coors Company in 20X2 is:

Definitions:

Interval

A range of values in statistics that describes the difference between two points, often used in the classification of scales of measurement.

Random Variable

A variable whose values depend on outcomes of a random phenomenon, with each outcome associated with a different value or set of values.

Occurrences

The instances or times that something happens or arises; the frequency of events.

Expected Value

The anticipated value or mean outcome of a variable, calculated as the sum of all possible values each multiplied by its probability of occurrence.

Q25: Trading securities are investments where there is

Q36: Accountants initially record costs by category.

Q88: A merchandising company has direct materials inventory.

Q100: When performing an engineering analysis, one must

Q116: The statement of cash flows is used

Q124: The current cost/nominal dollars method adjusts historical

Q163: Accounting information only helps assess past financial

Q167: An organization's debts due after one year

Q170: Investments made by lessee (tenant) that it

Q193: If the sales price per unit is