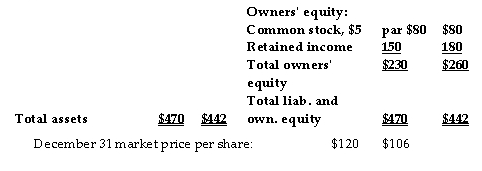

The following are the income statements and balance sheets for Coors Company:

32

32  The return on sales for Coors Company in 20X2 is:

The return on sales for Coors Company in 20X2 is:

Definitions:

Monetary Benefit

Financial gains or advantages, often resulting from employment, investments, or various forms of aid and compensation.

Disconnected Counselors

Therapists or advisors who are emotionally or mentally detached from their clients, potentially impacting the effectiveness of the counseling.

Client Devaluation

Refers to the process where the perceived value or importance of a client is reduced or diminished, possibly affecting the quality of service or attention they receive.

High Levels

A term indicating significant intensity, concentration, or degree of a particular trait, substance, or activity.

Q13: The following information is for Allen

Q14: Depreciation applies to assets such as accounts

Q54: An income statement that merely lists all

Q101: Given below is a list of events:

Q115: Cash collected from the customers before goods

Q139: Cash and all other assets that a

Q142: Goodwill can be recognized only when one

Q155: Roach Motel's cost function based on guest-

Q161: A gain on the sale of a

Q167: Recognizes the impact of transactions on the