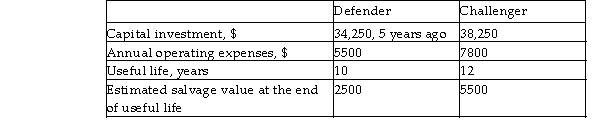

Razorback Corp. is evaluating whether it should keep its automatic guided vehicle or sell it immediately and purchase a new one. The current vehicle can be sold for $28,000 now; however, with an overhaul of $8250, the current vehicle can last another 5 years. Other relevant costs are shown below. Use a before- tax MARR of 5% per year and determine whether the current vehicle should be replaced.

Definitions:

Supplies Account

This is an account used in accounting to track the costs of supplies used in the operation of a business during an accounting period.

Wages Accrued

A liability representing wages earned by employees that have not yet been paid by the employer.

Rent Earned

Income received by a property owner when they lease out a property to a tenant.

Income Statement

A financial statement showing a company's revenue and expenses over a particular period, culminating in the net income or loss for that period.

Q6: Which of the following abbreviations means "twice

Q9: The ISO 9000 series is concerned with:<br>A)

Q10: A nurse is teaching an 85-year-old patient

Q12: The costs of manufacturing horizontal fixed- mount

Q17: The subject of the auditing procedure 'observation'

Q22: How has the role of the internal

Q25: An IV infusing at 24 mL/hr with

Q28: The Corporations Act does not require the

Q31: If a material misstatement is discovered in

Q38: By which route(s) can this drug be