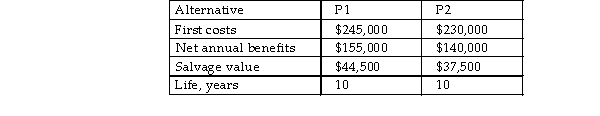

A logistics company is deciding between two models of semi- trailer trucks to add to its fleet. The manager has prepared the following information for the economic evaluation. The new trucks are to be used for 7 years and sold for the estimated salvage value. The before- tax MARR is 16.39% per year and the effective tax rate is 39%. Select a machine on the basis of after- tax annual worth analysis using MACRS with a 5- year recovery period.

Definitions:

Fair Value

The cost expected to be received for an asset sale or to be paid for transferring a liability during a well-organized interaction between market actors as of the valuation moment.

Subsidiary's Equity

The portion of equity (capital and reserves) in a subsidiary company that is attributable to its owners, including both parent and non-controlling interests.

Consolidation Adjusting Entries

Adjustments made in accounting records to remove the effects of intercompany transactions during the consolidation process for a group’s financial reporting.

Accounting Periods

Defined time frames in which financial transactions are recorded and financial statements are prepared.

Q1: KPMG's fraud survey identified a number of

Q5: Flowcharts should depict all of the following

Q10: What place value does the 7 hold

Q14: What is the purpose of tests of

Q15: In a continuous audit client information is

Q20: A conivaptan IV drip is infusing at

Q22: During the audit of XYZ Ltd the

Q26: What is the amount of equal annual

Q31: ABC Ltd recently established an audit committee

Q32: What is the generic name of this