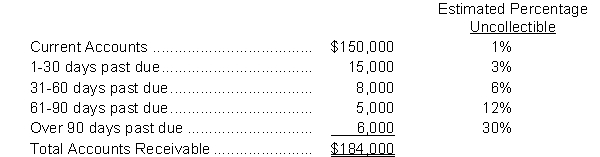

Broadway Limited had an $800 credit balance in Allowance for Doubtful Accounts at December 31, 2018, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following:  Instructions

Instructions

a. Prepare the adjusting entry at December 31, 2018, to recognize bad debts expense.

b. Assume the same facts as above except that the Allowance for Doubtful Accounts account had an $800 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's bad debts.

Definitions:

Farm Subsidies

Financial support and assistance given by the government to farmers and agribusinesses to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities.

Agricultural Output

The total quantity of agricultural products, such as crops and livestock, produced within a given period.

Capital Equipment

Long-term assets, such as machinery, buildings, or vehicles, that a business uses in the production of goods or services.

Farm Subsidies

Financial assistance provided by government to farmers, intended to stabilize food prices, ensure a stable food supply, and support farmers' incomes.

Q4: Once goods leave the premises of the

Q4: Under a perpetual inventory system<br>A) there is

Q6: The inventory cost formula that results in

Q11: An authorized signing officer should sign a

Q17: Cash restricted in use should be reported

Q23: Which of the following statements is false?<br>A)

Q54: Angel Hair Limited gathered the following reconciling

Q56: When closing entries are posted, the result

Q62: The purchase of an asset for cash<br>A)

Q91: When an impairment loss is recorded what