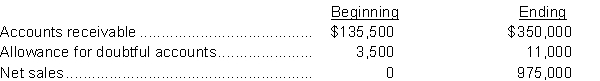

The following data are presented for Ratalan Ltd. for 2018:  InstructionsCalculate the receivables turnover and the average collection period for accounts receivable in days.

InstructionsCalculate the receivables turnover and the average collection period for accounts receivable in days.

Definitions:

Tax Bracket

A tax bracket is a range of incomes taxed at a particular rate within a tax system, influencing how much individuals or entities owe to the government.

Marginal Tax Rate

The rate of additional federal income tax to be paid on an extra dollar of income.

Average Tax Rate

The proportion of total income that is paid as taxes, calculated by dividing the total taxes paid by the total taxable income.

Federal Personal Income Tax

A tax levied by the federal government on the income of individuals, adjusted for various deductions and exemptions.

Q5: The abbreviation "FOB" stands for<br>A) free on

Q6: Freight costs incurred by a seller on

Q10: Under the perpetual inventory system, which of

Q17: In a period of rising prices, which

Q33: Revenue is only recorded when cash is

Q41: An employee who makes a sale, ships

Q63: The two ways that a corporation can

Q73: Under a perpetual inventory system, the cost

Q75: Fang's Tune-Up Shop Ltd. uses the accrual

Q86: Which of the following correctly identifies the