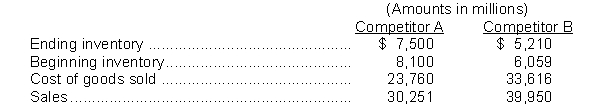

The following information is available from recent financial statements of Competitor A and Competitor B:  Instructions

Instructions

a. Calculate the inventory turnover and days in inventory for both companies.

b. What conclusions concerning the management of inventory can be drawn from these data?

Definitions:

FIFO Method

An inventory valuation method that assumes the first items placed in inventory are the first sold.

Conversion Costs

The costs incurred in the process of converting raw materials into finished goods, including direct labor and manufacturing overhead expenses.

FIFO Method

A method of inventory valuation where the first items purchased or produced are the first ones sold, used in costing inventory.

Conversion Costs

The combined expenses of direct labor and manufacturing overheads incurred in transforming raw materials into finished goods.

Q8: Beginning inventory plus purchases equals<br>A) cost of

Q17: Accounting information is not important to marketing

Q23: Both accounts receivable and notes receivable represent

Q33: When bonds are issued at a premium,

Q35: The time it takes to go from

Q36: Which of the following would not be

Q40: The account Allowance for Doubtful Accounts is

Q52: Cash received from a customer in advance

Q75: Anali Corporation has determined that its drilling

Q125: With regard to depreciation and income taxes,