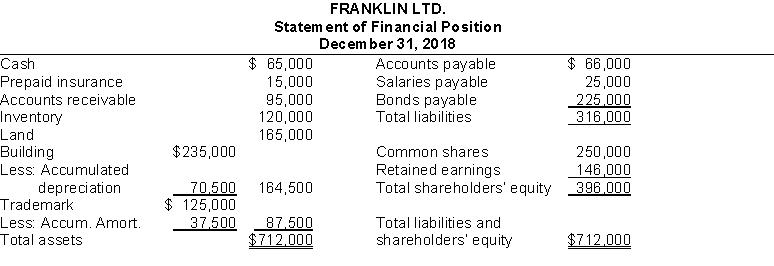

Use the following information to answer questions.

-Non-current liabilities total

Definitions:

Income Tax Rate

The fraction of earnings subject to taxation for either individuals or corporations.

Current Income Tax Liability

The amount of income tax that a company is obligated to pay to tax authorities within the current year.

Deferred Tax Asset

An accounting term that refers to a situation where a business has paid more taxes or estimates that it will pay more taxes than it will owe.

Warranty Expense

Costs a company incurs due to repairing or replacing products under warranty.

Q1: Why did AOL begin losing customers in

Q4: Presented below is the trial balance and

Q14: Freight costs incurred on incoming merchandise are

Q17: Which of the following statements is true?<br>A)

Q25: Companies present summarized financial information in the

Q31: Google is a subsidiary of YouTube.

Q37: Radio soap operas got their name because

Q58: Celebrating populism in postmodern culture can result

Q79: Long-term creditors are usually most interested in

Q85: Merchandise is sold for $2,500 with terms