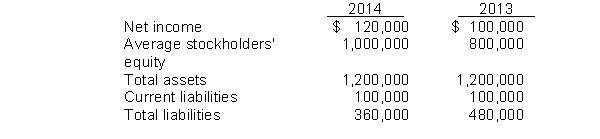

Mann Corporation decided to issue common stock and used the $120,000 proceeds to retire all of its outstanding bonds on January 1, 2014. The following information is available for the company for 2013 and 2014.  Instructions

Instructions

(a) Compute the return on common stockholders' equity for both years.

(b) Explain how it is possible that net income increased, but the return on common stockholders' equity decreased.

(c) Compute the debt to assets ratio for both years, and comment on the implications of this change in the company's solvency.

Definitions:

Loan Date

The date on which a loan agreement is signed and the funds are disbursed to the borrower.

Economic Value

Refers to the total value that an asset generates, encompassing both its direct financial performance and indirect benefits.

Interest Rate

The percentage charged on a loan or paid on savings or investments, typically expressed as an annual percentage of the principal.

Final Payment

The last payment made on a loan, debt, or financing agreement, completing the repayment obligation.

Q2: An expenditure for which of the following

Q11: Define par value, and discuss its significance

Q23: The book value of a plant asset

Q61: Generally, convertible bonds do not pay interest.

Q82: What are the phases of the corporate

Q105: Corporations are granted the power to issue

Q114: A company had net income of $242,000.

Q123: Metropolitan Symphony sells 200 season tickets for

Q157: In a recent year Ley Corporation had

Q263: Carpino Company purchased equipment and these costs