On January 1, 2012, Keller Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2013, more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Utilities Expense. Keller Company uses the straight-line method of depreciation.

Instructions

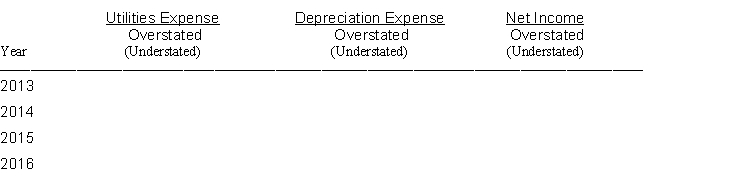

Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Definitions:

Units Produced

The total number of finished products manufactured during a specific period.

Indirect Manufacturing Cost

Costs related to manufacturing that cannot be directly traced to specific units of product, similar to manufacturing overhead, including expenses like factory supervision.

Units Produced

The total quantity of products manufactured by a company during a specific period.

Total Variable Cost

The sum of expenses that vary directly with the level of production or sales volume; these costs increase as production increases and decrease as production decreases.

Q33: A check returned by the bank marked

Q46: Doane Company receives a $7,000, 3-month, 6%

Q83: Accounts receivable are the result of cash

Q94: Which one of the following items would

Q141: A 90-day note dated June 30, 2014,

Q152: On January 1, 2014, $2,000,000, 5-year, 10%

Q177: Which requires a two-tiered approach to test

Q184: Bonds may be redeemed (retired) before maturity

Q195: All of the following are items that

Q243: Assuming that the allowance method is being