On January 1, 2012, Keller Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2013, more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Utilities Expense. Keller Company uses the straight-line method of depreciation.

Instructions

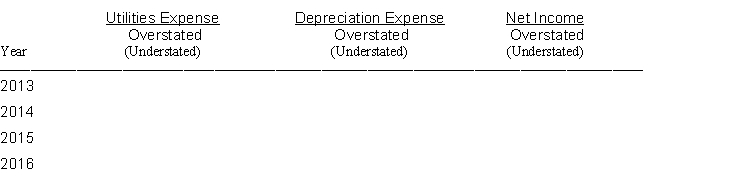

Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Definitions:

Rights To Protection

The entitlements that individuals or groups have to safeguard their personal integrity and freedom from harm, often guaranteed by law or international agreements.

Absolute

Unconditional or complete, often used to describe concepts that are considered universally valid or true.

Police Culture

The shared values, attitudes, and norms that characterize the policing profession and influence officers' behaviors and perceptions.

Formal Rules

Prescribed directives or guidelines designed to structure or govern behaviors and actions within specific contexts.

Q16: Ron's Quik Shop bought equipment for $70,000

Q29: Allowance for Doubtful Accounts is debited under

Q51: Equipment that cost $54,000 and on which

Q58: A check written by the company for

Q106: A debit balance in the Allowance for

Q146: When two or more people get together

Q217: If a retailer accepts a national credit

Q244: Which of the following is not true

Q250: The present value of a $10,000, 5-year

Q284: If bonds are issued at a discount,