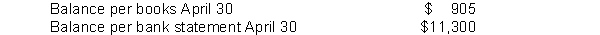

Grier Food Store used the following information in recording its bank reconciliation for the month of April.  (1) Checks written in April but still outstanding $6,300.

(1) Checks written in April but still outstanding $6,300.

(2) Checks written in March but still outstanding $2,800.

(3) Deposits of April 30 not yet recorded by bank $4,900.

(4) NSF check of customer returned by bank $500.

(5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549.

(6) Bank service charge for April was $40.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in April.

(8) The bank collected a note receivable for the company of $6,000 plus $240 interest revenue.

Instructions

Prepare a bank reconciliation at April 30.

Definitions:

Debt-Equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by shareholder equity.

Return On Assets

A measure of how effectively a company uses its assets to generate profit, calculated as net income divided by total assets.

Return On Equity

A measure of the profitability of a business in relation to the equity, calculated by dividing net income by shareholders' equity.

Profit Margin

A financial metric used to assess a company's profitability by comparing net income to sales. It's often expressed as a percentage indicating how much of each dollar in sales a company keeps as profit.

Q20: Classic Floors has the following inventory data:

Q51: Foyle Company needs to make adjusting entries

Q80: Which of the following items will increase

Q98: A post-closing trial balance will show:<br>A) zero

Q124: In the accounting cycle, closing entries are

Q160: At the beginning of the current period,

Q162: Of the following companies, which one would

Q176: The primary source used in the preparation

Q208: Management may choose any inventory costing method

Q280: A contra asset account is subtracted from