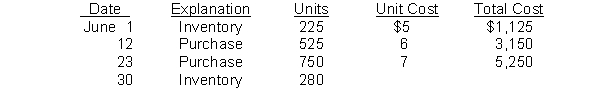

Johnson Company reports the following for the month of June.  (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why?

(c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO?

Definitions:

Consumer Surplus

The incongruity between the price consumers are willing to offer for a good or service versus the final cost.

Increase Supply

An upward shift in the supply curve, indicating more of a good or service is available for sale at any given price, usually the result of factors like improved technology or decreased production costs.

Consumer Surplus

Consumer surplus is the difference between the total amount that consumers are willing to pay for a good or service and the total amount they actually pay.

Soybeans

Edible legumes native to East Asia, widely grown for their numerous uses, which include producing oil, as a source of protein, and in many food products.

Q17: The FIFO reserve is a required disclosure

Q30: Use the following information for Boxter, Inc.,

Q65: Unearned revenue is classified as a(n):<br>A) asset

Q79: Greenstream Insurance Agency prepares monthly financial statements.

Q140: Under GAAP, companies can choose which inventory

Q161: Which of the following correctly identifies normal

Q189: James & Younger Corporation purchased a one-year

Q205: A major criticism of the FIFO inventory

Q232: Economic events that require recording in the

Q247: One part of an adjusting entry is