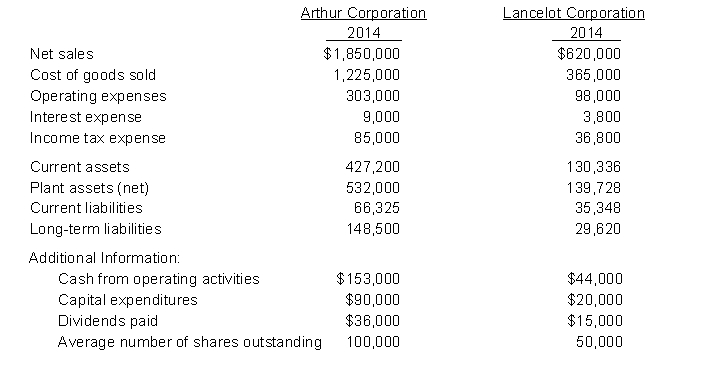

Comparative financial statement data for Arthur Corporation and Lancelot Corporation, two competitors, appear below. All balance sheet data are as of December 31, 2014.  Instructions

Instructions

(a) Comment on the relative profitability of the companies by computing the net income and earnings per share for each company for 2014.

(b) Comment on the relative solvency of the companies by computing the debt to assets ratio and the free cash flow for each company for 2014.

Definitions:

Face Value

This is the nominal or dollar value printed on a financial instrument, such as a bond or stock certificate, representing its value at issue.

Standard Deviation

A statistic that measures the dispersion or variability of a dataset or investment returns relative to its mean.

Call Option

A financial contract giving the buyer the right, but not the obligation, to purchase an asset at a specified price within a certain timeframe.

Strike Price

This is the fixed price at which the owner of an option can purchase (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Q31: The statements of financial position of Rocky

Q50: Evidence that would not help with determining

Q67: Bathlinks Corporation has a debt to assets

Q80: From the following list of selected accounts

Q109: The economic entity assumption states that economic

Q133: Deutsche Corporation's trading portfolio at the end

Q134: To show how successfully your business performed

Q143: A payment of a portion of an

Q167: Compute the missing amount in each category

Q200: Dawson Corporation has the following information available