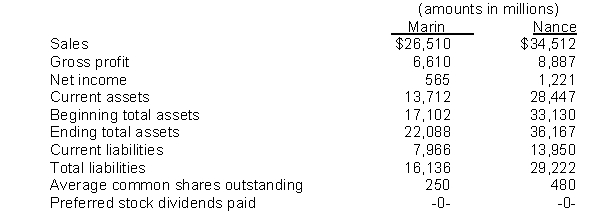

The following information is available from the annual reports of Marin Company and Nance Company.  Instructions

Instructions

(a) For each company, compute the following ratios:

1. Current ratio

2. Debt to assets ratio

3. Earnings per share

(b) Based on your calculations, discuss the relative liquidity, solvency, and profitability of the two companies.

Definitions:

Inventory Turnover

A figure representing the frequency at which a business's stock is both sold and refilled over an assigned period, showing the adeptness of inventory administration.

Accounts Receivable Turnover

A financial metric that measures how efficiently a company collects payments from its customers by dividing total sales by average accounts receivable.

Total Asset Turnover

A ratio that evaluates the effectiveness of a firm's utilization of its assets to produce sales income.

Equity Multiplier

A financial leverage ratio that measures the portion of a company's assets that are financed by its shareholders' equity.

Q23: The liability created by a business when

Q54: If $13,000 is deposited in a savings

Q64: To be faithfully representative, accounting information should

Q79: Payments to owners are operating activities.

Q87: The Cash account has a credit balance.

Q114: Which of the following discount rates will

Q116: Net income for the period is determined

Q141: A local retail shop has been operating

Q207: Under the equity method, the receipt of

Q225: The present value of a long-term note