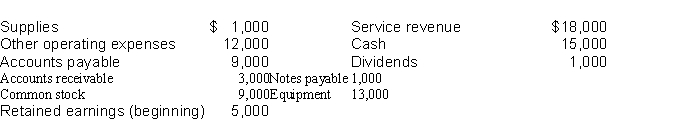

Use the following information to calculate for the year ended December 31, 2014 (a) net income (net loss), (b) ending retained earnings, and (c) total assets.  LO: 4,5, Bloom: AP, Difficulty: Medium, Min: 5, AACSB: Analytic, AICPA BB: Legal/Regulatory Perspective, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA: Reporting

LO: 4,5, Bloom: AP, Difficulty: Medium, Min: 5, AACSB: Analytic, AICPA BB: Legal/Regulatory Perspective, AICPA FN: Reporting, AICPA PC: Problem Solving, IMA: Reporting

Solution 178 (5 min.)

(a) $6,000 (b) $10,000 (c) $32,000

-Listed below in alphabetical order are the balance sheet items of Nolan Company at December 31, 2014. Prepare a balance sheet and include a complete heading.

Definitions:

Payroll Taxes Expense

The cost incurred by employers for taxes associated with employee salaries, such as Social Security and Medicare taxes.

FICA Social Security Taxes

Taxes collected under the Federal Insurance Contributions Act that fund Social Security and Medicare programs.

FICA Medicare

The portion of the U.S. Federal Insurance Contributions Act tax that funds Medicare, providing health insurance to individuals over 65 and some younger with disabilities.

Federal Unemployment Taxes

Taxes imposed by the federal government on employers to fund state unemployment agencies and provide unemployment compensation to workers who have lost their jobs.

Q8: The investment category on the balance sheet

Q38: The accountant for Mega Stores, Inc. should

Q42: Under the equity method, the investment in

Q61: U.S. standards are developed by the<br>A) IFRS.<br>B)

Q63: Valuing assets at their fair value rather

Q67: Broadway Corporation's stockholders' equity equals one-fourth of

Q96: The Unearned Service Revenue account is classified

Q112: Working capital is calculated by taking<br>A) current

Q139: Which of the following statements is true?<br>A)

Q207: Posting<br>A) transfers journal entries to ledger accounts.<br>B)