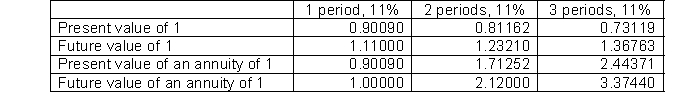

Wiggins Company is considering purchasing equipment. The equipment will produce the following cash flows: Year 1, $50,000; Year 2, $90,000; Year 3, $130,000. Below is some of the time value of money information that Wiggins has compiled that might help them in their planning and compounded interest decisions.  Wiggins requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Wiggins should pay for the equipment?

Wiggins requires a minimum rate of return of 11%. To the closest dollar, what is the maximum price Wiggins should pay for the equipment?

Definitions:

Pretax Profits

Earnings of a company before income tax expense has been deducted.

Borrowing Rate

The interest rate charged by a lender to a borrower for the use of borrowed money, often expressed as an annual percentage.

ROA

Return on Assets, an indicator of how profitable a company is relative to its total assets, showing how efficient management is at using assets to generate earnings.

ROE

Return on Equity: It's a financial performance indicator that is computed by dividing the net income by the equity held by shareholders.

Q27: Gross profit does not appear<br>A) on a

Q32: Which of the following is not a

Q70: Financial accounting ethics violations are<br>A) not a

Q82: The repurchase of shares may result in

Q85: Shares that have been issued and subsequently

Q95: Analyzing financial data on the same company

Q114: A purchase invoice is a document that<br>A)

Q175: A decline in a company's gross profit

Q189: If the single amount of $12,500 is

Q211: Claims of creditors and owners on the