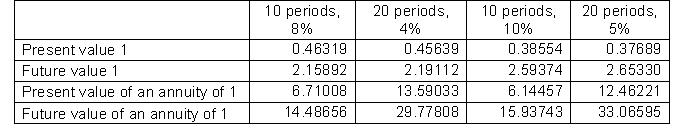

Patterson Company is about to issue $8,000,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The discount rate for such securities is 10%. Below are time value of money factors that Patterson uses to calculate compounded interest.  To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

To the closest dollar, how much can Patterson expect to receive for the sale of these bonds?

Definitions:

Utility Function

A representation of how a consumer ranks different bundles of goods according to their level of satisfaction or utility.

Income

Financial returns, especially continual, from work or investing activities.

Price of X

The amount of money required to purchase a product or service named X.

Consumption of Y

Represents the amount or volume of good Y that is utilized or consumed over a period.

Q28: Ando Company earns 11% on an investment

Q44: Which of the following is a short-term

Q48: Presented below are a series of financial

Q52: If a bond has a contract rate

Q52: Which of the basic rights of shareholders

Q53: Investors should be cautious when using non-IFRS

Q66: Elston Company compiled the following financial information

Q124: Liabilities<br>A) are future economic benefits.<br>B) are debts

Q137: Which of the following would not be

Q166: The company whose stock is owned by