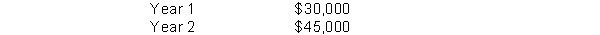

Akers Company is considering purchasing a machine. The machine will produce the following cash flows:  Akers requires a minimum rate of return of 10%. What is the maximum price Akers should pay for this machine?

Akers requires a minimum rate of return of 10%. What is the maximum price Akers should pay for this machine?

Definitions:

Modified Adjusted Gross Income

An individual's AGI with certain deductions added back in; used to determine eligibility for certain tax benefits.

Head of Household

A tax filing status for unmarried taxpayers who provide more than half the cost of maintaining a home for a qualifying person.

Adoption Credit

A tax credit offered to adoptive parents to cover some of the costs associated with the legal adoption of a child.

Special Rules

Regulations or provisions that apply in specific situations, often modifying or exempting certain transactions or entities from the general rules of tax law.

Q1: What is an advantage of using the

Q23: In a single-step income statement, all data

Q48: Ingles Company had the following transactions pertaining

Q76: Repurchasing shares<br>A) increases the number of shares

Q88: The figure for which of the following

Q119: Which of the following descriptions best describes

Q184: At January 1, 2014, the available-for-sale securities

Q186: Compound interest uses the accumulated balance-principal plus

Q239: A sales invoice is prepared when goods<br>A)

Q251: Compound interest is computed on the principal