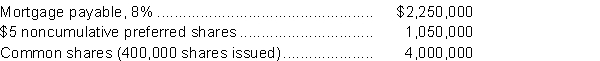

The statement of financial position for Hyde Corporation at the end of the current year includes the following:  Income before income tax was $1,850,000, and income tax expense for the current year was $550,000. Cash dividends paid on common shares was $200,000, and cash dividends paid on preferred shares was $100,000. The common shares were selling for $85 per share at year end.

Income before income tax was $1,850,000, and income tax expense for the current year was $550,000. Cash dividends paid on common shares was $200,000, and cash dividends paid on preferred shares was $100,000. The common shares were selling for $85 per share at year end.

Instructions

Calculate the following ratios:

a) Earnings per share

b) Price/earnings

c) Dividend yield

Definitions:

Milling Machine

A machine tool used to machine solid materials by rotating a cutting tool to remove material.

Constrained Resource

A limiting factor in production or project management that restricts output, such as limited materials, labor, or machine capacity.

Profitability

Refers to a company's ability to generate earnings over its costs and expenses within a specified time frame.

Absorption Costing

A costing method that includes all manufacturing costs—direct materials, direct labor, and both variable and fixed overhead—in the cost of a product.

Q5: When common or preferred shares are made

Q25: A pension plan that pays employees benefits

Q41: The shareholders' equity section of the statement

Q45: If a company has a stock investment

Q50: Review of the financial statements revealed the

Q74: Lenders would be most concerned with<br>A) debt

Q104: Under IFRS, income statement items classified by

Q118: It is important that the conclusion of

Q149: Under IFRS, companies must classify income statement

Q196: A buyer borrows money at 6% interest