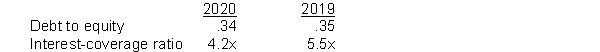

The debt to equity ratio and interest-coverage ratio for Vega Corporation for the last two years are as follows:  Which of the following conclusions could be made about Vega Corporation?

Which of the following conclusions could be made about Vega Corporation?

Definitions:

Budgeting Formulas

Mathematical expressions or equations used to calculate, allocate, and manage financial resources over a specific period.

Direct Materials

Materials that become an integral part of a finished product and whose costs can be conveniently traced to it.

Units

A measure or quantity chosen as a standard to express the size, amount, or dimension of something.

Flexible Budget

A budget model that modifies its allocations to reflect changes in operational activity levels, improving accuracy in financial planning and performance evaluation.

Q1: What is an advantage of using the

Q3: Which of the following methods of amortization

Q3: Which of the following liabilities is often

Q27: Historic financial results<br>A) help a lender determine

Q67: The direct writeoff method requires two journal

Q72: Cross-sectional analysis compares data from one company

Q98: Why would a company prefer to issue

Q118: Detailed records of goods held for resale

Q125: Under IFRS, companies can choose which inventory

Q178: If Hostell Company has net sales of