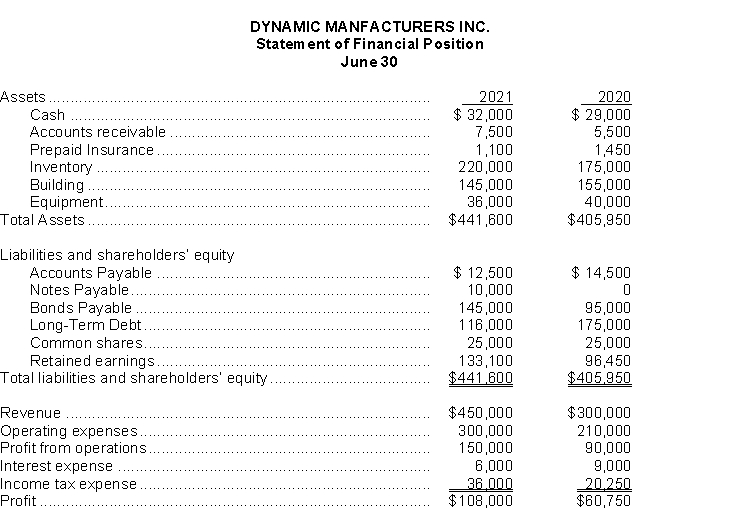

Dynamic Manufacturers Inc. reported the following information in its financial statements:  Instructions

Instructions

a) Calculate the company's debt to equity and times interest earned ratios for each year.

b) Determine if the change from 2020- 2021 is an improvement or deterioration.

c) If industry averages for debt to equity is 1.5:1 and times interest earned is 6 times, are Dynamic ratios comparable?

Definitions:

Maximize Profit

The economic goal of efficiently allocating resources in production to achieve the highest possible return or profit.

Start-up Firms

New business ventures that are in the early stages of operation, often characterized by innovative products or services and high growth potential.

United States

A country located in North America, comprised of 50 states, a federal district, five major self-governing territories, and various possessions.

Bankrupt

A legal situation in which an individual or firm finds that it cannot make timely interest payments on money it has borrowed. In such cases, a bankruptcy judge can order the individual or firm to liquidate (turn into cash) its assets in order to pay lenders at least some portion of the amount they are owed.

Q3: Which of the following liabilities is often

Q9: Canin Cranes Co. leased an asset under

Q17: Identify and describe the five limitations of

Q39: Given that most current liabilities will be

Q52: A major consideration for a company when

Q52: Assets acquired in a basket purchase are

Q64: Prairie Ink Company had reported the following

Q70: On July 1, 2020 a truck was

Q94: Information on a company's cash flows is

Q204: A credit sale of $1,900 is made