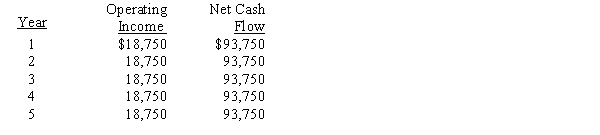

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-Motel Corporation is analyzing a capital expenditure that will involve a cash outlay of $208,240. Estimated cash flows are expected to be $40,000 annually for 7 years. The present value factors for an annuity of $1 for 7 years at interest of 6%, 8%, 10%, and 12% are 5.582, 5.206, 4.868, and 4.564, respectively. The internal rate of return for this investment is

Definitions:

Conflict

A situation where there is a disagreement or opposition between parties, which can stem from different views, interests, or goals.

Group Size

Refers to the number of individuals making up a group, which can impact the group's dynamics, interaction, and effectiveness.

Verbal Participation

The extent to which individuals contribute to discussions or communication through spoken words.

Conjunctive Tasks

Tasks in which group performance is limited by the performance of the poorest group member.

Q2: What are the "notes to the financial

Q69: The ratio of sales to investment is

Q78: For higher levels of management, responsibility accounting

Q79: Standard costs are a useful management tool

Q93: The support department allocation rate for Graphics

Q95: Describe a reason why CSR capital investments

Q109: Division A reported operating income of $975,000

Q164: List the four basic performance perspectives used

Q167: Which of the following statements about corporate

Q169: Which of the following is not one