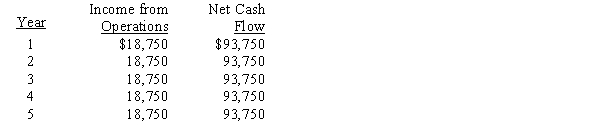

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The cash payback period for this investment is

Definitions:

SHIFT+RIGHT ARROW

A keyboard shortcut commonly used to select text or objects by extending the selection to the right.

Picture Tools Format

A feature or suite of tools in various software applications designed for editing and formatting images.

Currently Selected

The active selection or focus within a software environment, indicating that actions will apply to that item or area.

Default Color Scheme

The preset combination of colors selected or used by an application, which can often be customized by the user.

Q18: A qualitative characteristic that may influence capital

Q56: The section of an annual report that

Q72: For Years 1-5, a proposed expenditure of

Q89: By spending more in costs of controlling

Q96: Shareholders' equity is often referred to as

Q130: From the foregoing information, determine the production

Q147: Manufacturers must conform to the Robinson-Patman Act,

Q155: A company is contemplating investing in a

Q170: Heidi Company is considering the acquisition of

Q210: The primary disadvantage of decentralized operations is