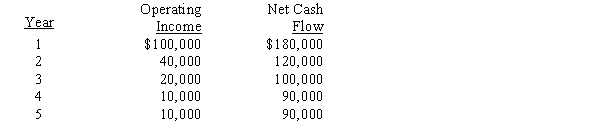

The management of Zesty Corporation is considering the purchase of a new machine costing $400,000. The company's desired rate of return is 10%. The present value factors for $1 at compound interest of 10% for Years 1 through 5 are 0.909, 0.826, 0.751, 0.683, and 0.621, respectively. In addition to the foregoing information, use the following data in determining the acceptability in this situation:  The cash payback period for this investment is

The cash payback period for this investment is

Definitions:

Q3: From the provided schedule of activity costs,

Q22: Where in the financial statements would a

Q57: Briefly explain the relationship between the management,

Q84: Accounting metrics, such as operating income, make

Q89: Which of the financial statements provides information

Q101: Assets are listed in the order of

Q130: The rate of earnings is 12% and

Q133: In an investment center, the manager has

Q137: The markup percentage on total cost for

Q150: Performance measurement systems use externally imposed benchmarks