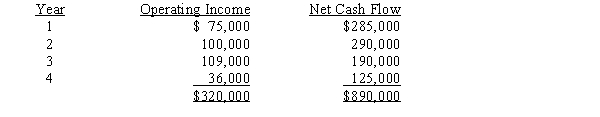

Dickerson Co. is evaluating a project requiring a capital expenditure of $810,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:  The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the average rate of return on investment.

The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is 0.893, 0.797, 0.712, and 0.636, respectively.Determine the average rate of return on investment.

Definitions:

Voucher System

A control mechanism in accounting that uses vouchers to record transactions and ensure that every payment is properly authorized.

Net Method

Refers to an accounting practice of recording purchases or sales of inventory after all discounts have been applied, showing the net amount as the transaction value.

Purchases Discount

A deduction from the stated purchase price, often granted to encourage early payment or bulk buying.

Q36: Using the tables provided, the present value

Q44: A nonfinancial measure is operating information that

Q49: The rate of earnings is 6% and

Q57: The difference between the standard cost of

Q79: Standard costs are a useful management tool

Q90: In using the variable cost method of

Q94: From the foregoing information, determine the amount

Q111: The expected period of time between the

Q153: The profit margin for the Central Division

Q198: Developing and retaining quality managers are advantages