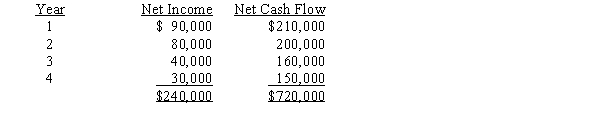

Vanessa Company is evaluating a project requiring a capital expenditure of $480,000. The project has an estimated life of 4 years and no salvage value. The estimated net income and net cash flow from the project are as follows:  The company's minimum desired rate of return for net present value analysis is 15%. The factors for the present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years are 0.870, 0.756, 0.658, and 0.572, respectively.Determine (a) the average rate of return on investment and (b) the net present value for the project.

The company's minimum desired rate of return for net present value analysis is 15%. The factors for the present value of $1 at compound interest of 15% for 1, 2, 3, and 4 years are 0.870, 0.756, 0.658, and 0.572, respectively.Determine (a) the average rate of return on investment and (b) the net present value for the project.

Definitions:

Quantity Demanded

The total amount of a good that consumers are willing to purchase at a given price level in a market.

Demand Curve

A graphical representation depicting the relationship between the price of a good and the quantity demanded by consumers, usually showing an inverse correlation.

Income Change

A variation in the amount of earnings received by a household or individual, which could arise from sources such as wages, investments, or benefits.

Price Change

Refers to the variance in the cost of goods or services over time, which can be an increase or a decrease.

Q19: Standard costs serve as a device for

Q63: Performance measurement systems use measures of current

Q68: Which of the following is an international

Q78: For higher levels of management, responsibility accounting

Q86: Which of the following is not a

Q91: Which of the following is not an

Q114: The cost price approach for transfer pricing

Q123: When several alternative investment proposals of the

Q128: Performance targets<br>A)provide goals for employees<br>B)are never linked

Q162: The operating income of the Super Division