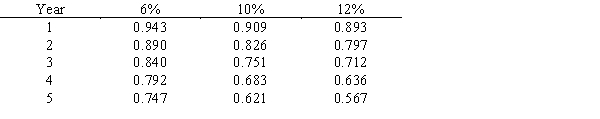

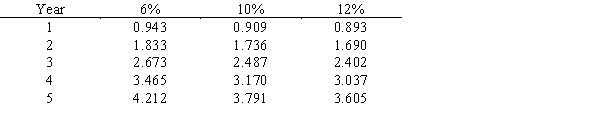

A project has estimated annual cash flows of $90,000 for 3 years and is estimated to cost $250,000. Assume a minimum acceptable rate of return of 10%. Using the following tables, determine (a) the net present value of the project and (b) the present value index, rounded to two decimal places.Following is a table for the present value of $1 at compound interest:  Following is a table for the present value of an annuity of $1 at compound interest:

Following is a table for the present value of an annuity of $1 at compound interest:

Definitions:

Flood Coverage

A specific type of insurance policy provision that provides compensation for damage or loss to property as a result of flooding.

Reformation

A legal process to correct or modify an existing contract or document to accurately reflect the parties' intentions due to errors or misunderstandings.

Consequential Damages

Compensatory damages awarded in a lawsuit for losses that do not directly arise from the action but are a consequence of the action.

Policy Limits

The maximum amount an insurance company will pay under a policy for a covered loss.

Q36: The direct labor rate variance is<br>A)$14,000 favorable<br>B)$14,000

Q40: Testing products<br>A)Prevention cost<br>B)Appraisal cost<br>C)Internal failure cost<br>D)External failure

Q49: Match each of the following activities to

Q59: Which of the following statements best describes

Q64: Cash payback method<br>A)Methods that do not use

Q96: Ivell Packaging Company produces paper and plastic

Q120: If the standard to produce a given

Q144: Standards are set for only direct labor

Q150: Hummingbird Company uses the product cost method

Q197: The major advantage of the return on