Norton Company is considering a project that will require an initial investment of $750,000 and will return $200,000 each year for 5 years.

a. If taxes are ignored and the required rate of return is 9%, what is the project's net present value?

b. Based on this analysis, should Norton Company proceed with the project?

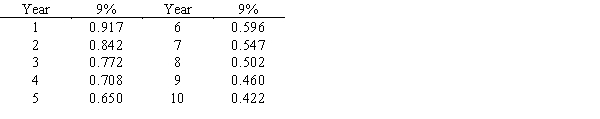

Following is a table for the present value of $1 at compound interest:

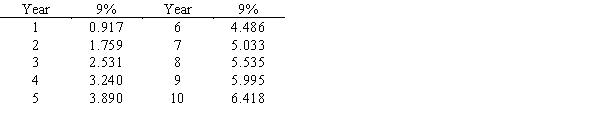

Following is a table for the present value of an annuity of $1 at compound interest:

Following is a table for the present value of an annuity of $1 at compound interest:

Definitions:

Henry L. Gantt

An American mechanical engineer and management consultant famed for developing the Gantt chart, a graphical scheduling tool for project management.

Differential Piece-rate Plan

A compensation system where workers are paid based on the quantity of items produced, with rates varying according to achieved efficiency thresholds.

Minimum Wage

The lowest legal hourly pay for workers, set by government regulation.

Scientific Management

An early management theory that emphasizes the use of scientific methods to determine the most efficient ways to work, enhance productivity, and reduce waste.

Q1: Constraint<br>A)Demand-based method<br>B)Competition-based method<br>C)Product cost method<br>D)Target costing method<br>E)Production

Q2: Which of the following results in fewer

Q26: The profit margin for Division C is

Q35: The balanced scorecard has four performance perspectives:

Q66: Only includes the costs of manufacturing in

Q80: AnaCarolina and Jaco work at Duke Manufacturing,

Q85: Identify and describe the two main types

Q92: An anticipated purchase of equipment for $490,000

Q101: Accounting metrics, such as cash flow, are

Q109: If the total unit cost of manufacturing