Project A requires an original investment of $65,000. The project will yield cash flows of $15,000 per year for 7 years. Project B has a computed net present value of $5,500 over a 5-year life. Project A could be sold at the end of 5 years for a price of $30,000. (a) Using the present value tables that follow, determine the net present value of Project A over a 5-year life with salvage value assuming a minimum rate of return of 12%. (b) Which project provides the greatest net present value?

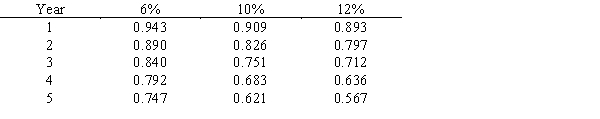

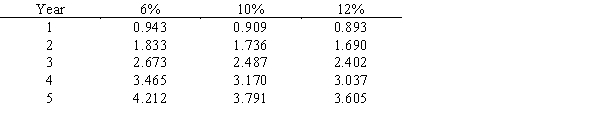

Following is a table for the present value of $1 at compound interest:  Following is a table for the present value of an annuity of $1 at compound interest:

Following is a table for the present value of an annuity of $1 at compound interest:

Definitions:

Residual Value

An asset's expected monetary value at the end of its operational lifespan.

Retired

The status of an individual who has left their professional career, often due to age or reaching financial independence that allows them not to work actively.

Estimated Value

An approximation of the monetary worth of an asset, liability, or a business, determined through analysis or professional judgment.

Fixed Asset

Long-term tangible property owned by a business, used in its operations and not expected to be consumed or converted into cash in the short term.

Q3: Sierra Company produces its product at a

Q17: Mighty Safe Fire Alarm is currently buying

Q22: If operating income for a division is

Q61: Bentz Co. has two divisions, A and

Q81: Which of the following is an example

Q99: The variable cost per unit for the

Q104: With lean manufacturing, employees are trained to

Q111: Farris Company is considering a cash outlay

Q138: What is capital investment analysis? Why are

Q166: If the standard to produce a given