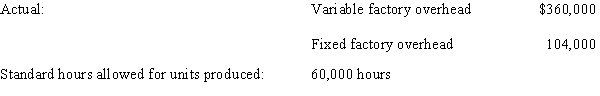

The standard factory overhead rate is $7.50 per machine hour ($6.20 for variable factory overhead and $1.30 for fixed factory overhead) based on 100% of normal capacity of 80,000 machine hours. The standard cost and the actual cost of factory overhead for the production of 15,000 units during August were as follows:

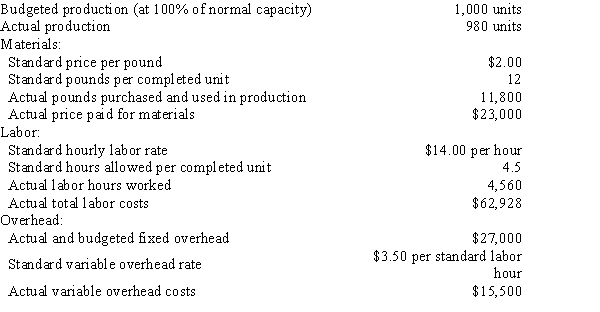

-The following data are given for Bahia Company:  Overhead is applied on standard labor hours.The fixed factory overhead volume variance is

Overhead is applied on standard labor hours.The fixed factory overhead volume variance is

Definitions:

Normal Balance

The part of an account (either debit or credit) that is used to log increments in the account's value.

Financial Statement

A formal record of the financial activities and position of a business, individual, or other entity, including balance sheets, income statements, and statements of cash flows.

Permanent/Temporary

Refers to accounts or methods in accounting that either endure indefinitely (permanent) or have an expiration or closing time (temporary).

Reversing Adjustments

Reversing Adjustments are accounting entries made at the beginning of a new accounting period to cancel out adjusting entries made at the end of the previous period to simplify financial reporting.

Q3: The fixed factory overhead volume variance is<br>a.$9,000

Q16: Moon Company uses the variable cost method

Q43: The dollar amount of desired profit from

Q78: A firm operated at 90% of capacity

Q99: The capital expenditures budget summarizes plans for

Q100: Variable costing is appropriate only for manufacturing

Q108: Data for Divisions A, B, C, D,

Q153: Diamond Boot Factory normally sells its specialty

Q155: A plan showing the units of goods

Q223: The graph of a variable cost when