Use this information for Taylor Company to answer the questions that follow.

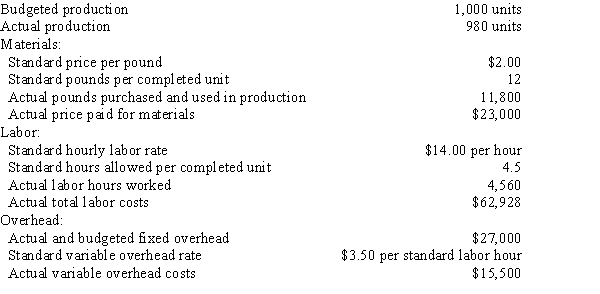

The following data are given for Taylor Company:

Overhead is applied based on standard labor hours.

Overhead is applied based on standard labor hours.

-Compute the direct labor rate and time variances for Taylor Company.

Definitions:

Fixed Costs

Overheads that are unaffected by the quantity of output or sales, for example, tenancy costs, wages for staff, and indemnity expenses.

Contribution Format

A type of income statement presentation that separates fixed and variable costs, allowing for an easier assessment of how changes in volume affect profitability.

Contribution Format

A way of presenting income statements where variable costs are deducted from sales to find the contribution margin, then fixed costs are deducted to find net operating income.

Break-even Point

The level of production or sales at which total revenues equal total expenses, resulting in neither profit nor loss.

Q9: If variable manufacturing costs are $15 per

Q9: Purchase requisitions for Purchasing and the number

Q37: Direct labor cost is an example of

Q45: On January 1 of the current year,

Q62: On the absorption costing income statement, deduction

Q64: Which of the following would not be

Q117: The contribution margin ratio is computed as

Q125: Big Wheel, Inc., collects 25% of its

Q135: Lofty Airlines has a flight for which

Q154: The markup percentage for the sale of