Prepare an income statement that includes variances for the year ending December 31 through gross profit for Baxter Company using the following information. Baxter Company sold 8,600 units at $125 per unit. Normal production is 9,000 units. (Do not round fixed overhead rate calculation when determining fixed factory overhead volume variance.)

Definitions:

Carrying Value

The book value of an asset or liability on a company's balance sheet, calculated as the original cost minus depreciation or amortization.

Unearned Ticket Revenue

Revenue received from ticket sales before the event or service has been provided; also considered a liability until earned.

Adjusting Journal Entry

An accounting record posted at the conclusion of a fiscal period with the purpose of assigning revenues and expenses to their correct time frame.

Season Tickets

Tickets sold for a set number of events or performances, typically for concerts, theater performances, or sports events.

Q15: Tippi Company produces lamps that require 2.25

Q18: Which of the following is not a

Q41: The unit selling price for Magpie's product

Q67: The total direct materials cost variance is<br>A)$9,262.50

Q104: Greyson Company produced 8,300 units of product

Q118: Rodger's Cabinet Manufacturers uses flexible budgets that

Q124: Woodpecker Co. has $296,000 in accounts receivable

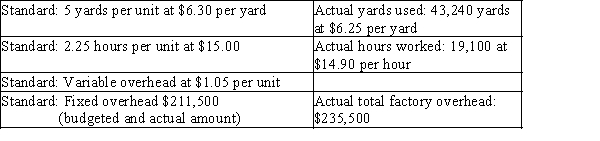

Q128: The standard costs and actual costs for

Q154: An unfavorable fixed overhead volume variance can

Q223: The graph of a variable cost when