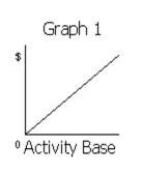

Match each of the following costs with the graph (a-e) that best portrays its cost behavior as the number of units produced and sold increases.

-Per-unit cost of direct materials

A)Graph 1

B)Graph 2

C)Graph 3

D)Graph 4

E)Graph 5

Definitions:

Unit Cost

Unit cost is the total expenditure incurred to produce, store, and sell one unit of a product or service, including both fixed and variable costs.

U.S. Tax System

The structured collection of taxes imposed by the federal, state, and local governments in the United States, including income, sales, and property taxes.

Taxation Basis

Refers to the underlying system or set of rules used to determine how much tax an individual or entity owes.

Saving

The process of setting aside a portion of current income for future use, typically in a bank account or other investment vehicle.

Q5: Under absorption costing, the cost of finished

Q12: Louis Company sells a single product at

Q41: The sequential method of allocating support department

Q71: Which of the following is not an

Q109: Penny Company sells 25,000 units at $59

Q116: Given the following information:<br>Variable cost per unit

Q119: The amount of operating income that would

Q125: Big Wheel, Inc., collects 25% of its

Q140: At the beginning of the period, the

Q228: Salaries of internal pattern designers<br>A)Variable cost<br>B)Fixed cost<br>C)Mixed