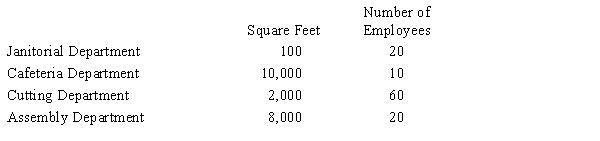

Using the direct method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has the following information about its two service departments and two production departments, Cutting and Assembly:  If the Cafeteria Department incurs costs of $500,000, how much of that cost is allocated to the Assembly Department?

If the Cafeteria Department incurs costs of $500,000, how much of that cost is allocated to the Assembly Department?

Definitions:

Marginal Cost

The additional cost incurred in producing one more unit of a good or service.

Variable Cost

Costs that change in proportion to the level of production or sales activity of a business.

Total Cost

The overall expense incurred in the production of goods or services, including both fixed and variable costs.

Fixed Cost

Expenses that do not change with the level of production or sales, such as rent, salaries, or insurance premiums.

Q38: None of the four common methods for

Q52: The journal entry to record the flow

Q70: Departmental information for the four departments at

Q71: The following data are for Trendy Fashion

Q73: If sales are $425,000, variable costs are

Q108: The cost of energy consumed in producing

Q135: Mocha Company manufactures a single product by

Q171: Explain the concept of equivalent units. Give

Q203: If a business had sales of $4,000,000

Q224: If yearly insurance premiums are increased, this