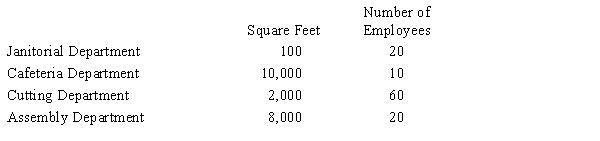

Using the direct method, Pone Hill Company allocates Janitorial Department costs based on square footage serviced. It allocates Cafeteria Department costs based on the number of employees served. It has the following information about its two service departments and two production departments, Cutting and Assembly:  If the Cafeteria Department incurs costs of $500,000, how much of that cost is allocated to the Assembly Department?

If the Cafeteria Department incurs costs of $500,000, how much of that cost is allocated to the Assembly Department?

Definitions:

Income Summary

An accounting tool used to aggregate all income and expense accounts to determine net income or loss for a period.

Revenue

Income that a company receives from its normal business activities, usually from the sale of goods and services to customers.

Closing Entries

Closing entries are journal entries made at the end of an accounting period to transfer temporary account balances to permanent accounts, thereby resetting the temporary accounts for the next period.

Withdrawal Account

An account that tracks the money taken out of a business by its owners for personal use.

Q22: Managers will often find it necessary to

Q44: At the beginning of the period, there

Q52: Activity-based costing is much easier to apply

Q53: Salary of the night-time security guard of

Q82: Stevens Company's inventory on March 1 and

Q84: Because variable costs are assumed to change

Q96: The three categories of manufacturing costs comprising

Q120: Management will use both variable and absorption

Q168: If sales total $2,000,000, fixed costs total

Q187: Reynolds Manufacturers Inc. has estimated total factory