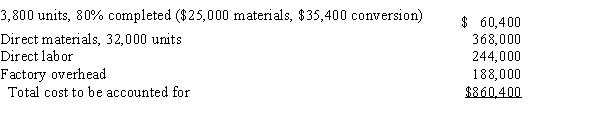

The inventory at June 1 and costs charged to Work in Process-Department 60 during June are as follows:  During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units that were 40% completed. Inventories are costed by the weighted average method and all materials are added at the beginning of the process.Determine the following, presenting your computations:

During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units that were 40% completed. Inventories are costed by the weighted average method and all materials are added at the beginning of the process.Determine the following, presenting your computations:

a.Equivalent units of production for conversion cost

b.Conversion cost per equivalent unit and material cost per equivalent unit

c.Total and unit cost of finished goods completed in the current period

d.Total cost of work in process inventory at June 30

Definitions:

Electronic Funds Transfer

A system of transferring money from one bank account directly to another without any paper money changing hands, often using online banking platforms.

Employee Check Stub

A document that accompanies an employee’s salary, detailing the breakdown of their earnings and deductions.

Bank Account Numbers

Unique identifiers assigned to an account in a bank, used for identification and processing financial transactions.

Employer's Quarterly Federal Tax Return

A form filed by employers to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks, and to pay the employer's portion of Social Security or Medicare tax.

Q8: Activity-based costing can be beneficial in allocating

Q49: Office equipment depreciation<br>A)Direct<br>B)Indirect<br>C)Neither direct nor indirect

Q63: The document authorizing the issuance of materials

Q71: Which of the following is the formula

Q81: A job order cost accounting system provides

Q90: Journalize the entries to record the following

Q124: Product costs<br>A)appear only on the balance sheet<br>B)appear

Q132: The reciprocal services method of allocating support

Q152: Douglas Company has a contribution margin ratio

Q155: Transportation out<br>A)Product cost<br>B)Period cost