Mocha Company manufactures a single product by a continuous process, involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 1 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $55,000, $65,000, and $80,000, respectively. In addition, work in process at the beginning of the period for Department 1 totaled $75,000, and work in process at the end of the period totaled $60,000.

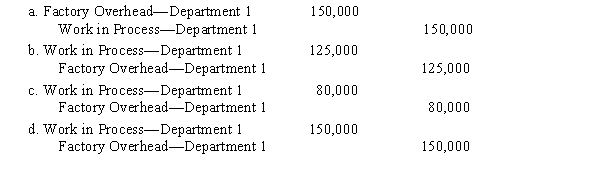

-The journal entry to record the flow of costs into Department 1 during the period for applied overhead is

Definitions:

Differential Rate

A differential rate refers to a pricing strategy where the rate charged varies based on certain conditions or parameters, often seen in shipping or finance sectors.

Commission Charges

Fees paid to agents or brokers for their services, typically a percentage of the transaction value.

Total Purchase Costs

refers to the aggregate cost of buying an item or service, including the purchase price, taxes, shipping, and any additional fees.

Net Change Column

This refers to a column in financial reporting that shows the difference in a particular financial metric's value from one period to the next.

Q4: Each document in the cost ledger is

Q18: When using multiple production department rates, there

Q34: Which of the following explains why it

Q96: Steven Company has fixed costs of $160,000.

Q100: Costs other than direct materials cost and

Q105: The single plantwide overhead rate method is

Q107: Assuming that all direct materials are placed

Q123: All of the following could be considered

Q160: Labor costs that are directly traceable to

Q233: Accounting salaries<br>A)Variable cost<br>B)Fixed cost<br>C)Mixed cost