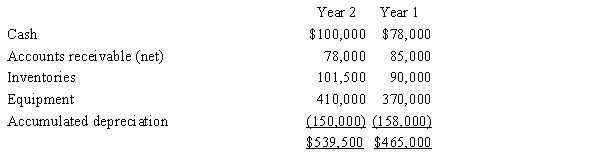

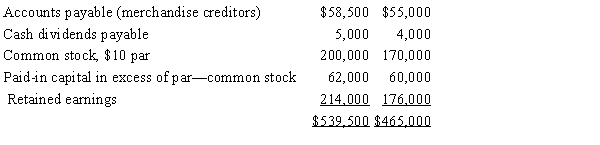

The following data for Larson Co. for the year ending December 31, Year 2, and the preceding year ended December 31, Year 1, are available:

In addition to the balance sheet data, assume that: Equipment costing $125,000 was purchased for cash. Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000. The stock was issued for cash. The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.What are the net cash flows from operating, investing, and financing activities for Year 2?

In addition to the balance sheet data, assume that: Equipment costing $125,000 was purchased for cash. Equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000. The stock was issued for cash. The only entries in the retained earnings account were net income of $51,000 and cash dividends declared of $13,000.What are the net cash flows from operating, investing, and financing activities for Year 2?

Definitions:

Costs

The amount of money required to produce or acquire goods or services, including manufacturing, purchasing, and marketing expenses.

Taxes

Compulsory financial charges or levies imposed on individuals or entities by a governmental organization in order to fund public expenditures.

Accounts Payable

Obligations of a company to pay off short-term debts to its suppliers or creditors.

Net Working Capital

This is the difference between a company's current assets and its current liabilities, indicating its short-term financial health and ability to cover short-term obligations.

Q27: If the dividend amount of preferred stock,

Q30: Use the following tables to calculate the

Q32: A balance sheet shows cash, $75,000; marketable

Q54: Rho, Sigma, and Tau Companies have the

Q66: The excess of issue price over par

Q70: useful for comparing one company to another

Q150: Differentiate between period and product costs and

Q162: Acquisition of treasury stock

Q192: Those most responsible for the major policy

Q195: A financial statement showing each item on