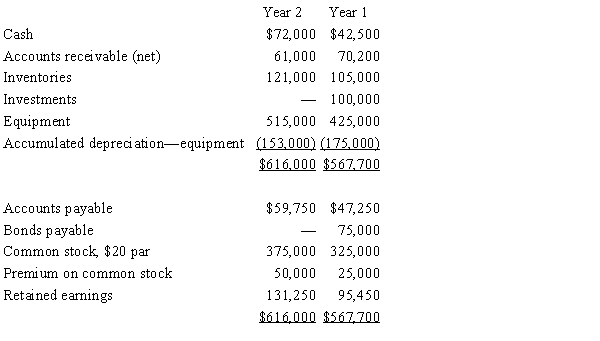

The comparative balance sheet of Barry Company for Years 1 and 2 ended December 31 appears below in condensed form:  Additional data for the current year are as follows: (a) Net income, $75,800.(b) Depreciation reported on income statement, $38,000.(c) Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.(d) Bonds payable for $75,000 were retired by payment at their face amount.(e) 2,500 shares of common stock were issued at $30 for cash.(f) Cash dividends declared and paid, $40,000.(g) Investments of $100,000 were sold for $125,000.

Additional data for the current year are as follows: (a) Net income, $75,800.(b) Depreciation reported on income statement, $38,000.(c) Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.(d) Bonds payable for $75,000 were retired by payment at their face amount.(e) 2,500 shares of common stock were issued at $30 for cash.(f) Cash dividends declared and paid, $40,000.(g) Investments of $100,000 were sold for $125,000.

What are the net cash flows from operating, investing, and financing activities for Year 2?

Definitions:

Game Theory

A field of study that models and analyzes strategic interactions among rational decision-makers.

Game Theory

A study of strategic decision making, analyzing interactions with formalized incentive structures ("games").

Strategic Choices

Decisions made by individuals or organizations that have significant long-term implications on their objectives and activities.

Prisoners' Dilemma

A situation in game theory where two individuals acting in their own self-interest do not produce the optimal outcome for either party.

Q10: Discount on Bonds Payable is a contra

Q25: If a firm has a quick ratio

Q32: Balance sheet and income statement data indicate

Q36: Horizontal analysis is a technique for evaluating

Q43: The accounting for defined benefit plans is

Q118: Notes may be issued<br>A)when assets are purchased<br>B)to

Q125: If Epsilon Company's price-earnings ratio on common

Q138: A company reports the following:<br>Sales<br>$2,400,000<br>Average total assets

Q202: In the hotel industry, the occupancy rate

Q211: Oregon, Inc. reported net income of $105,000.