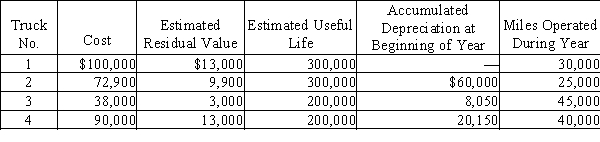

Prior to adjustment at the end of the year, the balance in Trucks is $300,900 and the balance in Accumulated Depreciation-Trucks is $88,200. Details of the subsidiary ledger are as follows:  Required:

Required:

(a)Based on the units-of-output method, determine the depreciation rates per mile and the amount to be credited to the accumulated depreciation section of each of the subsidiary accounts for the miles operated during the current year.(b)Journalize the entry to record depreciation for the year.

Definitions:

Firm's Output

The total quantity of goods or services produced by a business within a specific period.

Short-Run Supply

The quantity of goods and services that producers are willing and able to offer for sale at different prices over a short period, during which at least one input is fixed.

Long-Run Supply

The total quantity of goods or services that a market can produce and provide over a long period, considering all relevant input adjustments.

Lowest Price

The minimum cost at which a product or service is offered in the market.

Q14: The transfer to expense of the cost

Q17: On the first day of the fiscal

Q24: Amortization Expense<br>A)Current Assets<br>B)Fixed Assets<br>C)Intangible Assets<br>D)Current Liability<br>E)Long-Term Liability<br>F)Owners'

Q47: Selling receivables is called<br>A)factoring<br>B)sales revenue<br>C)a factor<br>D)sold receivables

Q103: A legal document that indicates the name

Q119: McKay Company sells merchandise with a one-year

Q146: The payroll register of Seaside Architecture Company

Q165: The journal entry used to record the

Q172: The total earnings of an employee for

Q190: During periods of decreasing costs, the use