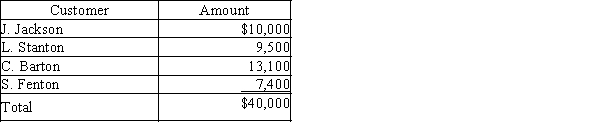

Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:  Required:

Required:

(a)Journalize the write-offs for the current year under the direct write-off method.(b)Journalize the write-offs for the current year under the allowance method. Also, journalize the adjusting entry for uncollectible receivables assuming the company made $2,400,000 of credit sales during the year and the industry average for uncollectible receivables is 1.50% of credit sales.(c)How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Definitions:

Foreign Corrupt Practices Act

A U.S. law that prohibits American companies and their employees from bribing foreign officials to gain a business advantage.

President Jimmy Carter

Former President of the United States from 1977 to 1981, known for his focus on human rights, diplomacy, and environmental issues.

Foreign Government Officials

Individuals who hold positions of authority or service in the government of a country other than one's own.

Business

The practice of engaging in commerce, trade, or services with the intention of generating profit and economic growth.

Q43: For each of the following scenarios, indicate

Q65: Land acquired as a speculation is reported

Q72: Allowance for Doubtful Accounts has a credit

Q81: Inventory at the end of the year

Q97: A capital expenditure results in a debit

Q147: Functional depreciation occurs when a fixed asset

Q170: Direct disposal costs do not include special

Q193: Discuss the (a) focus and (b) financial

Q195: Event is remote and amount is not

Q209: At the beginning of the year, the