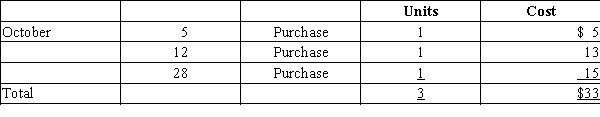

Assume that three identical units of merchandise were purchased during October, as follows:  Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the average cost method.

Assume one unit is sold on October 31 for $28. Determine cost of goods sold, gross profit, and ending inventory under the average cost method.

Definitions:

Non-Eligible Dividends

Dividends that are paid out by companies from earnings that have not been taxed at the corporate level and are subject to different tax treatment at the receiver's end compared to eligible dividends.

Capital Gains

The profit earned from the sale of an asset, such as stocks, bonds, or real estate, when the sale price exceeds the purchase price.

Marginal Tax Rates

are the rates at which the last dollar of a taxpayer’s income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Total Tax

The cumulative amount of taxes that an individual or entity is obligated to pay to the government, including federal, state, and local taxes.

Q14: Discount Mart utilizes the allowance method of

Q44: Fill in the blanks related to the

Q55: A check for $342 was erroneously charged

Q60: Allowance for Doubtful Accounts has a credit

Q117: Dalton Company uses the allowance method to

Q122: The entry to close Dividends would be<br>A)debit

Q145: For each of the following, explain whether

Q152: What is the amount of cost of

Q232: Selected data from the ledger of Beck

Q235: Assume that the total inventory counted at