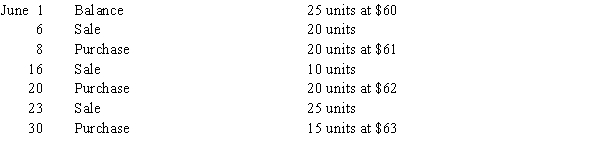

The following data regarding purchases and sales of a commodity were taken from the related perpetual inventory account:  Calculate the cost of the ending inventory at June 30, using (a) the first-in, first-out (FIFO) method and (b) the last-in, first-out (LIFO) method. Identify the quantity, unit price, and total cost of each lot in the inventory.

Calculate the cost of the ending inventory at June 30, using (a) the first-in, first-out (FIFO) method and (b) the last-in, first-out (LIFO) method. Identify the quantity, unit price, and total cost of each lot in the inventory.

Definitions:

Cost Structure

Cost structure denotes the various types of expenses a business incurs and is typically categorized into fixed and variable costs, influencing pricing and profitability.

Driver's Side Air Bag

A safety device installed in vehicles to reduce the risk of injury to the driver in the event of a collision by rapidly inflating upon impact.

Automobile Manufacturer

A company that produces and sells vehicles designed for transporting people and goods on roads.

Property Taxes

Taxes assessed on real estate properties, based on the property's value, and paid to local governments.

Q13: The amount of deposits in transit is

Q27: A summary of selected transactions in ledger

Q54: Diane's Designs purchased a one-year liability insurance

Q73: The accumulated depreciation account is closed to

Q82: The actual cash received during the week

Q88: Receipts from cash sales of $3,200 were

Q100: The difference between accounts receivable and allowance

Q150: In the periodic inventory system, purchases of

Q191: During August, the first month of the

Q204: Under the perpetual inventory system, a company